Developing banking software in 2026 requires a meticulously planned approach due to evolving threats, regulations, and sky-high customer expectations. The digital banking landscape is fiercely competitive, with institutions racing to deliver convenience and security without compromising compliance.

When banks or fintechs get software development wrong, the costs can include lost trust, regulatory penalties, or catastrophic breaches. A successful digital banking transformation hinges on robust, secure, and compliant software built to solve real customer needs. This guide offers a practical playbook for banking software development—covering the complete process, cost factors, technology decisions, compliance updates, and partner selection. By the end, you’ll be prepared to plan, budget, and execute a successful banking software project.

What Is Banking Software Development?

Banking software development refers to the creation, integration, and deployment of specialized digital systems that power the operations, services, and compliance of financial institutions. Unlike generic financial software, banking software is built to process sensitive transactions, maintain regulatory compliance, and provide seamless customer experiences across digital and traditional channels.

Types, Scope, and Use Cases

- Core Banking Systems: Platforms that manage bank accounts, payments, loans, and reporting.

- Digital & Mobile Banking Apps: Interfaces for customers to perform transactions, manage finances, and engage with the bank 24/7.

- Payment Gateways & Integration Platforms: Enable secure processing of card and digital payments.

- Lending & Credit Platforms: Support loan applications, underwriting, servicing, and compliance tracking.

- Open Banking APIs: Secure frameworks for third-party data exchange, required by regulations such as PSD2 and emerging PSD3.

The scope of banking software spans retail banks, neobanks, payment institutions, and B2B financial service providers. Each faces regulatory mandates—including KYC (Know Your Customer), AML (Anti-Money Laundering), and global data privacy standards—impacting how software is designed, built, and maintained.

What Are the Main Types of Banking Software & Must-Have Features?

Banking software comes in several specialized categories, each tailored to unique operational needs and customer demands. Identifying the right type and feature set is critical to meeting both business and regulatory requirements.

Core Types of Banking Software

- Core Banking Systems: Account management, real-time transaction processing, customer records.

- Digital/Mobile Banking Apps: User authentication, mobile deposits, P2P payments, notifications.

- Payment Gateways/Platforms: PCI DSS compliance, multi-channel payment support, fraud detection modules.

- Lending Platforms: Digital onboarding, risk scoring, loan servicing, regulatory reporting.

- CRM & Analytics Platforms: Customer engagement, personalization, marketing automation.

- Risk Management & Fraud Detection: Real-time monitoring, AI-driven anomaly detection, audit logs.

Feature Matrix

| Software Type | Must-Have Features |

| Core Banking System | Secure account mgmt, real-time transaction engine, regulatory audit |

| Mobile Banking App | Multi-factor auth, intuitive UI/UX, instant alerts, device biometrics |

| Payment Gateway | PCI-DSS encryption, dynamic risk scoring, fast settlement |

| Lending Platform | Online identity verification, credit scoring, e-signatures, KYC/AML |

| Fraud Detection | AI analytics, rule-based triggers, real-time dashboards |

| Open Banking Integration | PSD2/PSD3-compliant APIs, consent mgmt, third-party data flows |

Choosing features should be guided by current regulatory obligations and customer journey mapping, ensuring both security and usability.

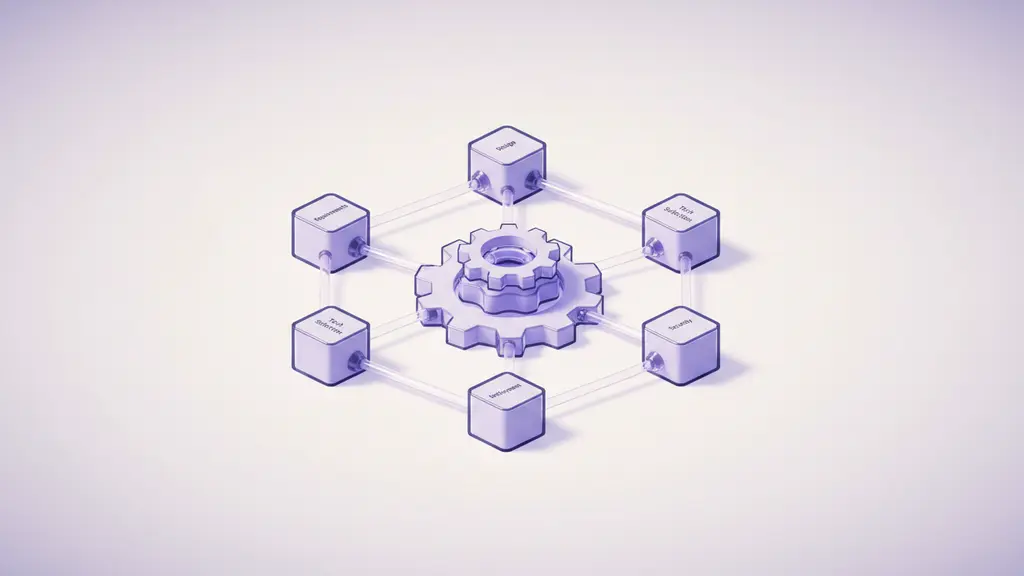

What Does the Banking Software Development Process Look Like?

Banking software development follows a systematic, multi-stage lifecycle designed to ensure security, compliance, and functionality. Each phase demands careful planning and execution.

Step-by-Step Process Overview

- Requirements Gathering & Project Planning

- UI/UX Design

- Technology Selection & Backend Architecture

- Security & Compliance Implementation

- Quality Assurance & Testing

- Deployment, Support, & Ongoing Maintenance

Let’s break down each stage.

Requirements Gathering & Project Planning

A successful project begins with deep stakeholder engagement and thorough research.

- Interview stakeholders from compliance, operations, and customer channels.

- Document regulatory requirements (e.g., PSD2/PSD3, GDPR, AML/KYC).

- Map detailed user/customer journeys and pain points.

- Prioritize business goals and technical constraints.

Case Example:

A European challenger bank reduced rework by 25% after dedicating extra time to interview their compliance and fraud prevention teams during initial planning.

UI/UX Design Principles for Financial Apps

Effective UI/UX design in banking software combines usability, accessibility, and trust.

- Develop user-centric wireframes and flowcharts.

- Prioritize clear navigation, accessibility (WCAG), and responsive layouts.

- Use real-world UI patterns: simple dashboards, prominent call-to-action, clear feedback on transactions.

Tips:

– Use familiar interface cues to build trust.

– Design for accessibility to serve all demographics (visual/physical impairments).

Choosing Technologies & Backend Architecture

Technology choices shape your system’s reliability, scalability, and cost.

- Popular Backend Languages: Java, .NET, Python (for integrations), chosen for reliability and auditability.

- Cloud Infrastructure: AWS, Azure, Google Cloud enable scale and compliance (with regional data residency).

- Architecture Patterns:

– Microservices: Favored for scalability, resilience, and easier compliance isolation.

– Monolithic: Faster for MVPs/small institutions but limited long-term flexibility. - API Integrations: Securely plug into payment gateways, KYC providers, and open banking standards.

Diagram:

_A process flow would normally be inserted here: Requirements → Wireframes → Tech Stack → API/Cloud Design → Security Layer → QA → Go-Live._

Ensuring Security & Compliance from Day One

Security and compliance are embedded throughout, not bolted on after development.

- Risk Assessment: Identify sensitive data, threat vectors, and fraud risks.

- Compliance Embedding:

– PCI DSS for payments

– PSD2/PSD3 for open banking

– GDPR (EU), CCPA (US), or equivalent for data protection

– KYC/AML obligations - Data Security Controls:

– End-to-end encryption

– Secure audit trail logging

– Role-based access, regular code reviews

Expert Insight:

“The European Banking Authority’s latest guidance on PSD3 emphasizes real-time consent tracking and transparent API security”—European Banking Authority, 2026.

Quality Assurance, Testing & Continuous Delivery

High-quality banking software focuses as much on prevention as detection.

- Integrate both automated and manual testing (unit, integration, penetration).

- Include dedicated compliance and security test cases.

- Use CI/CD pipelines for fast, iterative releases while maintaining stability.

QA Focus Areas:

– Transaction accuracy

– Regulatory reporting validation

– Security hardening (pen testing, vulnerability scans)

Deployment, Support, & Ongoing Maintenance

After launch, ensure robust support and continuous improvement.

- Deployment Strategies:

– Phased rollouts (pilot with limited users, then scale up)

– “Big bang” launches (higher risk, used rarely) - Monitoring and Support:

– 24/7 uptime monitoring

– Incident response playbooks

– User feedback loops - Continuous Compliance:

– Monitor regulatory updates

– Conduct regular audits

– Update security protocols proactively

Anecdote:

A Tier 2 bank transitioning to cloud saw its support tickets drop by 30% after automating compliance checks and integrating real-time monitoring.

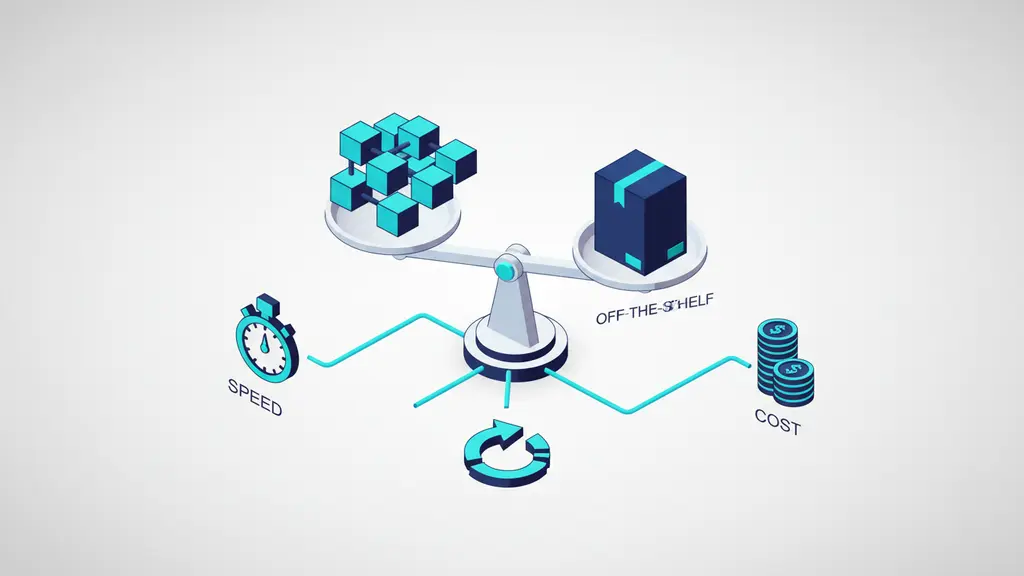

How Do You Choose Between Custom and Off-the-Shelf Banking Solutions?

Choosing between custom and off-the-shelf banking solutions is a pivotal decision, shaping flexibility, speed to market, and total cost of ownership.

Custom vs. Off-the-Shelf Comparison

| Factor | Custom Banking Software | Off-the-Shelf Solutions |

| Fit to Needs | Fully tailored to workflows | Predefined, limited by vendor |

| Scalability | Designed for future growth | Varies by vendor tier |

| Time to Market | Longer (6–18 months or more) | Rapid (weeks to a few months) |

| Compliance Control | Direct, highly customized | Follows vendor’s updates |

| Upfront Cost | High | Medium to high |

| Ongoing Costs | Predictable, but maintenance | Licensing, upgrade fees |

| Vendor Lock-in | Low (if code owned) | Can be high |

Decision Scenarios

Choose custom development if:

- You seek differentiated customer experiences.

- Regulatory needs require unique processes.

- Integration with legacy/back-office systems is complex.

Opt for off-the-shelf solutions if:

- Speed is your top priority.

- Use cases fit standard bank workflows.

- You have limited IT resources.

Migration Note:

Transitioning from legacy systems often reveals latent complexity—customization or integration middleware is frequently required.

How Much Does It Cost to Develop Banking Software?

![How Much Does It Cost to Develop Banking Software? [Cost & Resource Planning]](https://riseuplabs.com/wp-content/uploads/2026/02/how-much-does-it-cost-to-develop-banking-software-cost-resource-planning.webp)

Banking software development costs are influenced by software type, feature complexity, compliance needs, and delivery strategy.

Key Cost Drivers

- Feature Set: More features (e.g., multi-currency, chatbots) increase cost.

- Integrations: Open banking APIs, third-party compliance tools.

- Security & Compliance: Meeting standards such as PCI DSS, PSD2 adds audit and testing complexity.

- Team Size & Skills: Specialists in compliance, security, or AI command higher rates.

- Development Method: In-house vs. outsourced; onshore vs. offshore rates.

Typical Cost Ranges

| Project Type | Approx. Cost Range (USD) |

| Mobile Banking App (MVP) | $100,000 – $250,000+ |

| Full Core Banking System | $500,000 – $2,000,000+ |

| Payment Gateway Integration | $50,000 – $200,000+ |

| Lending/Credit Platform | $150,000 – $500,000+ |

Cost Note:

Numbers are indicative—actuals depend on region, vendor reputation, and scope. Allow for a 15–25% buffer for ongoing compliance updates.

In-house vs. Outsourcing

- In-House: Greater control, slower, often higher fixed costs.

- Outsourcing: Access to global expertise, potentially lower cost, but requires due diligence on partner’s compliance and security record.

How Do You Select the Right Banking Software Development Partner?

Selecting a banking software partner is a crucial step with long-term impact on risk, compliance, and business success.

Evaluation Criteria

- Relevant Experience: Proven track record with financial services and banking clients.

- Compliance Expertise: Evidence of recent projects meeting PSD2/3, PCI DSS, KYC/AML requirements.

- Technical Stack Proficiency: Familiarity with your selected backend, cloud, and API strategies.

- Security Record: History of secure software delivery; third-party audits or certifications.

- Case Studies & References: Request verifiable examples and client feedback.

- Project Management Approach: Agile, DevOps maturity, support for iterative releases.

Sample RFP Checklist

- Detailed compliance requirements (by geography, business line)

- Technology and integration expectations

- Data privacy and security policies

- Post-deployment support arrangements

- SLAs for uptime, incident response

Red Flags to Watch

- Unwillingness to share references or audits

- “One-size-fits-all” approach to compliance

- Lack of ongoing support, unclear handover

Success Signal:

Partners who proactively discuss compliance, share recent regulatory lessons, and provide transparent costs tend to deliver stronger long-term value.

What Are the Latest Trends & Challenges Shaping Banking Software in 2026?

In 2026, banking software development is shaped by fast-moving regulations, new technologies, and evolving security threats.

Key Trends

- PSD3 and Regulatory Expansion:

The upcoming Payment Services Directive 3 (PSD3) will drive more granular consent management and expanded open banking requirements, especially in the EU. - AI/ML Adoption:

Banks are investing in artificial intelligence for fraud detection, risk scoring, and hyper-personalized customer experiences. Real-time data analysis is now a baseline expectation. - Cloud & Open Banking APIs:

Institutions continue migrating to cloud-native stacks and deploying API-first architectures to enable fintech partnerships and compliance with open banking rules. - Legacy System Modernization:

Migration from legacy mainframes to modular, cloud or microservice-based core banking platforms remains a pressing challenge—often requiring multi-year programs. - Security Threats:

Emerging risks include sophisticated phishing (deepfakes), ransomware attacks, and the need for continuous compliance-monitoring automation.

Key Steps to Develop Banking Software

| Step | What it Covers | Key Deliverables |

| 1. Requirements & Planning | Stakeholder, market, and compliance analysis | Detailed specs, user journeys, roadmap |

| 2. UI/UX Design | Workflow, accessibility, prototyping | Wireframes, design system |

| 3. Technology & Architecture Selection | Stack, patterns, integration approach | Architecture diagrams, stack selection |

| 4. Security & Compliance | Data security, audit, regulatory alignment | Compliance checklists, risk logs |

| 5. QA & Testing | Functional, security, compliance, performance testing | Test cases, bug/issue logs |

| 6. Deployment & Support | Go-live, monitoring, support structure | Go-live plan, monitoring dashboards |

| 7. Ongoing Maintenance | Updates, compliance, user feedback loops | Maintenance plan, audit results |

FAQ: Banking Software Development (Expert Q&A)

What are the main steps in banking software development?

The process typically includes requirements gathering, UI/UX design, technology and architecture selection, embedding security and compliance, extensive QA/testing, deployment, and post-launch maintenance.

Which compliance standards are mandatory for banking software?

Common standards include PSD2/PSD3 for payment services, PCI DSS for payment data security, GDPR (in the EU) for personal data protection, and KYC/AML for anti-money laundering obligations. Requirements may vary by region.

How secure is custom-developed banking software?

Custom banking software can be highly secure when built by experienced teams following best practices for encryption, secure coding, and continuous security testing. However, security depends on ongoing maintenance and quick response to emerging threats.

How much does it cost to develop banking software?

Costs vary widely based on complexity, scope, and compliance needs. A mobile banking app may cost $100,000–$250,000+, while a full core banking platform can exceed $500,000. Ongoing maintenance and compliance updates are additional.

What technologies are best for banking app development?

Popular choices include Java or .NET for backend, React Native or Flutter for mobile frontends, and cloud platforms such as AWS or Azure. Technology choices should align with security, scalability, and compliance requirements.

Should I choose custom or off-the-shelf banking software?

Choose custom if your needs are unique or you require complete process control. Off-the-shelf is ideal for standard use cases and rapid deployment, but may impose limits on customization and integration.

What is the difference between fintech and core banking software?

Core banking software handles fundamental operations—accounts, transactions, reporting—while fintech apps often focus on innovative services like digital wallets, P2P payments, and AI-driven experiences.

How to ensure compliance after deployment?

Maintain regular compliance audits, monitor regulatory updates, and integrate real-time alerting for changes that impact software or data handling.

How do you select a banking software development partner?

Evaluate partners based on relevant experience, compliance record, security expertise, technical fit, and referenceable case studies. Review SLAs and ensure transparent communication.

What trends are emerging in banking software for 2026?

Key trends include the move towards modular, cloud-native architectures; adoption of AI for fraud/risk management; API-driven open banking; and readiness for new regulations like PSD3.

Conclusion

Strategic, compliant, and user-centric software development is now the defining factor for banks and fintechs who want to thrive in 2026 and beyond. By following a structured process—from thorough requirements planning to robust testing, and by partnering with the right experts—you can launch secure, scalable, and regulation-ready solutions.

Equip your team with proven frameworks, stay abreast of regulatory changes, and never underestimate the value of objective partner evaluation. For banks ready to transform, now is the time to start your journey with the tools and best practices outlined here.

Key Takeaways

- Banking software development requires strategic planning to ensure compliance, security, and customer trust.

- Distinguish carefully between core banking, mobile banking, payment, and open banking platforms before starting.

- Embed compliance (PSD2/PSD3, PCI DSS, GDPR) and security from project inception—not as an afterthought.

- Factor for significant cost, choosing wisely between custom and off-the-shelf options based on business needs.

- Continuous monitoring and partner due diligence are essential for long-term software success.

This page was last edited on 6 February 2026, at 6:27 pm

Contact Us Now

Contact Us Now

Start a conversation with our team to solve complex challenges and move forward with confidence.