SaaS application development for GCC markets demands more than just code—it requires deep regional alignment on compliance, localization, and deployment.

Traditional SaaS guides rarely address the Middle East’s complex regulatory landscape, Arabic-first experience, and cloud/data constraints. In the GCC (Gulf Cooperation Council: UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman), success hinges on meeting strict data residency laws, adapting to local payment systems, and delivering seamless Arabic interfaces.

This playbook delivers a sequenced, actionable blueprint for building and scaling SaaS in the GCC—with proven models for compliance, cost control, and user adoption.

By following this guide, decision-makers unlock the region’s explosive SaaS growth while avoiding deal-killing pitfalls and ensuring long-term product viability.

GCC SaaS Market Landscape: Trends, Adoption, and Key Segments

The GCC SaaS market is growing rapidly, driven by digital transformation, robust cloud infrastructure, and supportive regulations.

Key market trends:

- According to Statista and regional IT reports, the GCC SaaS market is valued at over $1.5 billion in 2024, with an expected CAGR exceeding 15% in leading economies.

- The UAE and Saudi Arabia are leading adopters, prioritizing SaaS in digital government, fintech, and enterprise sectors.

- Major growth drivers include national digital mandates (e.g., Saudi Vision 2030), increased cloud maturity, and regulatory pushes towards SaaS procurement.

High-impact verticals:

- Fintech: Regulatory sandboxes and eKYC acceleration.

- Real Estate: CRM, property management, and transaction SaaS platforms.

- Healthcare: Hospital management, telemedicine, and compliance-driven applications.

- Retail & E-commerce: Omnichannel SaaS and payment integration.

| Segment | Market Growth | Adoption Drivers | Notable Requirements |

| Fintech | 20%+ | Digital banks, compliance | PDPL, KSA SAMA rules |

| Real Estate | 18% | PropTech, e-signature, cloud CRMs | Data residency, Arabic UX |

| Healthcare | 15% | Telehealth, data privacy mandates | PDPL, sector certifications |

| Retail | 16% | E-invoicing, regional payments | VAT/FATOORA, RTL, multi-currency |

The GCC offers a fast-maturing, opportunity-rich SaaS landscape—but only for solutions built with local-first compliance and experience.

What Are the Regulatory and Compliance Requirements for SaaS in GCC?

GCC SaaS compliance is multi-faceted, covering data privacy, taxation, invoicing, and AI governance, with each country maintaining its own key rules.

Featured Regulations Across GCC:

- UAE PDPL (Personal Data Protection Law): Mandates lawful processing, data localization, and explicit consent.

- KSA PDPL: Requires prior approval for cross-border data transfer and DPO roles.

- VAT (Value-Added Tax): 5–15% rates (varies by country); SaaS is taxable, requiring region-ready VAT invoices.

- FATOORA (KSA): Electronic invoicing mandate for all digital services.

- ISO 42001: Emerging AI/automation governance framework, especially relevant for AI-powered SaaS.

Compliance Checklist for GCC SaaS:

| Requirement | Applicability | Key Actions |

| PDPL | UAE, KSA, Bahrain | Consent records, cross-border controls |

| VAT | All GCC | Local invoice format, Arabic/English invoices |

| FATOORA e-Invoicing | Saudi Arabia | E-invoice engine, integration with ZATCA APIs |

| Data Residency | UAE, KSA, Qatar | Local/cloud hosting, geo-fencing, backups |

| ISO 42001 | Growing region-wide | AI/automation transparency, audit trail readiness |

Risks of non-compliance:

Heavy administrative fines, blocked market access, refusal of procurement bids, and reputational damage.

Where to find official rules:

Consult the UAE Data Office, Saudi Data & AI Authority, and official sites for VAT/FATOORA regulations.

How Do You Architect SaaS for the GCC? Models, Data Residency & Approved Cloud Providers

Designing SaaS for the GCC means balancing compliance, performance, and cost—starting with architecture, data residency, and local cloud.

Multi-tenancy in GCC SaaS

Multi-tenancy determines how customers share application resources:

- Shared Database: All tenants in one DB—cost-efficient, but more challenging for strict data isolation.

- Isolated Schema: Each tenant has a separate schema—improves compliance and migration options.

- Isolated Database (Single-Tenancy): Each tenant is completely separated—often required for regulated sectors like government, finance, or healthcare.

| Model | Pros | Cons | Typical Use |

| Shared DB | Lower ops cost, easy scale | Tougher data isolation | SMB, lower compliance apps |

| Isolated Schema | Mid-cost, easier compliance | Higher migration/resource needs | Mid-market, regulated apps |

| Single-Tenancy | Maximum isolation | Highest cost, less agile scaling | Banks, public sector |

Tip:

Industry and client compliance often dictate the required tenancy model.

Data Residency Laws: UAE vs. KSA vs. the Region

- UAE PDPL: Strong preference for local cloud hosting; certain sectors (banking, health) require in-country storage.

- KSA PDPL: Explicit restrictions on external data transfers; must use approved local or in-KSA cloud zones.

- Qatar: Similar data localization mandates, especially for government and healthcare applications.

- Oman, Bahrain, Kuwait: Progressively increasing requirements; check latest country guidance.

Comparison of Cloud Providers:

| Cloud Provider | Country/Zone | Compliance Notes |

| AWS (UAE) | UAE, Bahrain | Local data residency, full native support |

| Azure (UAE, KSA) | UAE, Saudi Arabia | National cloud for compliant sectors |

| Google Cloud | Out-of-region | May fail residency for some industries |

| G42 Cloud | UAE (Abu Dhabi) | Strategic for government/public sector |

| Local Providers | Varies | Sector-aligned, check audit history |

Architecture Blueprint: Secure, Scalable, Compliant SaaS

- Use local or in-country cloud zones where data residency is mandated.

- Apply tenancy model based on compliance need (e.g., government often demands separate databases).

- Ensure geo-fenced backups and disaster recovery.

- Implement RBAC (Role-Based Access Control) for cross-tenant security.

When single-tenancy is required:

Banking, healthcare, and government SaaS projects often mandate this due to auditability and data sovereignty.

Arabic-First SaaS Localization: UX, Billing, and Regional Workflows

Localized SaaS experiences—spanning interface, billing, and workflow—are crucial for GCC adoption and regulatory fit.

Critical Aspects of SaaS Localization for the Middle East

- Arabic UX & Right-to-Left (RTL) Support:

— Full RTL alignment for layouts and forms.

— Context-aware translation—avoid direct/literal translation pitfalls.

— Accessible text size and contrast, with support for dual languages (Arabic/English). - Billing & Invoicing Localization:

— Generate VAT-compliant invoices in Arabic (and English).

— Support KSA FATOORA requirements—QR codes, e-invoicing via ZATCA APIs.

— Address fields with local structure (region, building number, district). - Regional Payment Methods & APIs:

— Integrate with local gateways such as Mada (KSA), stc pay, and GCC-issued credit cards.

— Support cash-on-delivery and SADAD (KSA) where segment-appropriate. - Legal/Compliance Through Localization:

— Capture and validate legal Arabic names per government standards.

— Use address formats accepted by GCC regulatory bodies.

Common pitfalls to avoid:

— Hardcoded LTR layouts causing broken flows in Arabic.

— Inconsistent translation undermining trust.

— Failing to test edge scenarios like VAT billing, long Arabic names, and regional holidays.

What Does SaaS Application Development Cost in GCC Markets?

SaaS application development costs in GCC markets vary widely by scope, complexity, compliance, and localization needs.

SaaS Development Cost Comparison (AED/USD)

| Project Level | Typical Cost (AED) | Typical Cost (USD) | Features Included |

| MVP Build | 160,000–350,000 | 45,000–100,000 | Core modules, Arabic UI, VAT billing, cloud hosting, basic compliance |

| Mid-Market Product | 350,000–900,000 | 100,000–250,000 | Multi-tenancy, integrations (payments, VAT/FATOORA), SLA support |

| Enterprise Solution | 900,000+ | 250,000+ | Advanced localization, tenant isolation, custom workflows, audits |

Main cost drivers:

— Compliance (e.g., PDPL, VAT, e-invoicing)

— Deep localization: bilingual UI, RTL, legal workflow support

— Payment and API integrations (with local gateways)

— Hosting: data residency or single-tenant deployments require premium zones

Recurring vs. Upfront Costs:

Recurring: Cloud infrastructure, compliance audits, ongoing localization, security updates.

Upfront: Development, solution architecture, initial legal/technical reviews.

Example:

A real estate SaaS MVP for Dubai, with Arabic-first UI, PDPL compliance, and payment integration, typically starts around AED 200,000–300,000 (USD 55,000–80,000), with incremental costs for enhanced tenancy or deep integrations.

Cost Optimization:

Adopt phased builds—start with an MVP that passes regulatory reviews, then scale up with added features per market demand.

Technical Best Practices: Integration, Security & Scalability in the GCC

Reliable SaaS in the GCC requires robust regional integrations, security that meets local rules, and scalable design for multi-country reach.

Proven Practices:

- Payment Gateway Integration:

— Select regionally certified APIs—ensure full KYC/AML compliance logic.

— Test for card/bank acceptance across GCC countries and regulatory sandbox environments. - Data Security:

— Encrypt customer data at rest and in transit; use regionally approved encryption standards where required (e.g., AES 256 for KSA).

— Ensure all cross-border API calls log consent and meet PDPL requirements. - Identity & Access Controls (RBAC):

— Apply least-privilege policies per tenant/user type.

— Prepare for regional audit requests (role change logs, activity audit trails). - Scalability Engineering:

— Use containerized architectures or managed PaaS for seamless scaling across Gulf data centers.

— Plan for latency optimization: leverage in-region caching, CDNs. - Local API Integration:

— Connect with government and business endpoints—e.g., FATOORA (KSA), VAT filing APIs, regional eID systems.

How Does AI and Automation Shape GCC SaaS? ISO 42001 and Beyond

AI and automation are transforming SaaS in the GCC—but raise new governance and compliance needs, led by ISO 42001.

ISO 42001:

This international standard governs AI Management Systems (AIMS), focusing on organizational transparency, data governance, and auditability—critical as GCC regulators formalize AI oversight.

Applications for SaaS:

- Automated Compliance: Real-time VAT/FATOORA checks, onboarding, fraud detection.

- Personalized Experiences: AI-powered Arabic language support, adaptive workflows.

- Risk Management: Algorithm transparency for auditability under PDPL and ISO 42001.

Future Trends:

— Growing regulatory alignment around AI/automation transparency.

— Increased procurement requirements for ISO 42001 or equivalent certification.

— AI features as core differentiators—but only for providers equipped for region-specific oversight.

Forward-looking SaaS solutions embrace AI with clear ethical frameworks, regionally governed data handling, and continuous compliance monitoring.

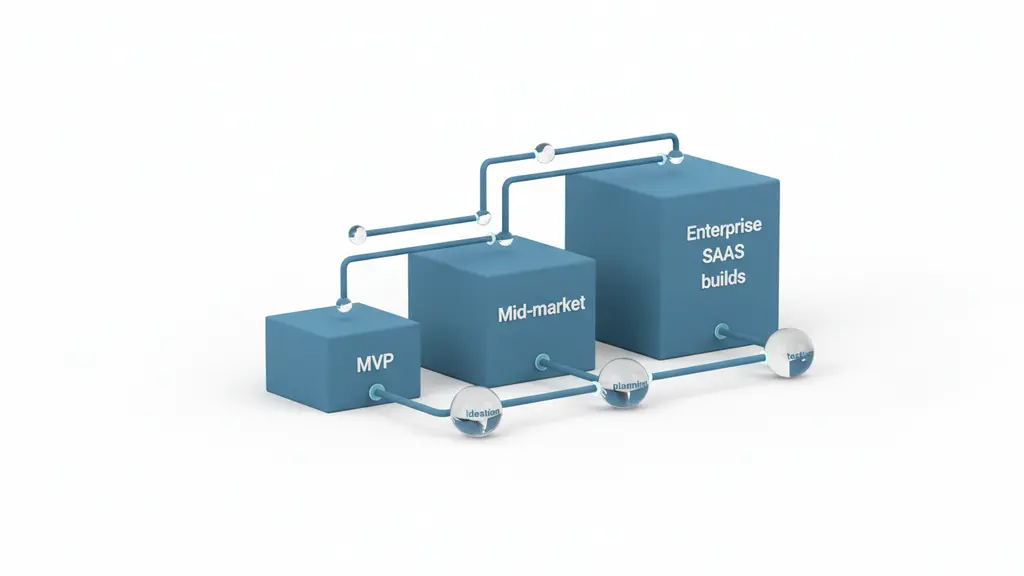

Step-by-Step: GCC SaaS Build & Scale Blueprint (From MVP to Enterprise)

Building a successful GCC SaaS application requires a sequenced, compliance-first approach from ideation to enterprise scaling.

6-Step GCC SaaS Development Blueprint:

- Ideation:

— Validate product-market fit for the GCC with regional user interviews and competitor analysis.

— Engage regulatory consultants early to assess mandatory requirements. - Planning:

— Map legal obligations per country—PDPL, VAT, FATOORA.

— Incorporate Arabic-first UX/UI and plan for tenancy/localization in phase one. - MVP Build:

— Choose cloud/data stack for target market; implement core compliance features (data residency, bilingual UI, audit logs).

— Integrate primary payment processors and establish VAT-compliant invoicing. - Testing:

— Conduct deep QA in both Arabic and English—including RTL flows.

— Simulate infrastructure failover for latency and backup readiness. - Go-Live:

— Monitor adoption, manage country-by-country go-live, and switch tenancy model if necessary.

— Launch tailored onboarding in Arabic and enable local compliance feedback loops. - Enterprise Scaling:

— Secure regional certifications (ISO, local cloud approvals).

— Continuously audit for new regulations (PDPL updates, AI governance).

— Localize advanced modules/workflows for new verticals or markets.

Quick Reference: GCC SaaS Launch Checklist

- Regulatory mapping completed

- Cloud/data residency validated

- MVP localization (UX/UI) delivered

- Billing/VAT ready

- Regional API integrations tested

- Go-live support in both Arabic/English

Founders’ Pitfalls: What to Avoid When Building SaaS for GCC

Learning from common mistakes can save months and hundreds of thousands of AED.

Top 5 Founder Mistakes in GCC SaaS:

- Underestimating Compliance Timelines: Approval (esp. PDPL audits) can take 3–9 months.

- Ignoring Arabic UX: Hardcoded LTR only or poor localization causes high churn and trust breakdown.

- Choosing the Wrong Tenancy Model: Inflexible architecture leads to trapped technical debt and failed tenders.

- Neglecting Data Residency/Cloud Approval: Rejecting client security questions or cloud certifications often blocks deals.

- Billing & VAT Errors: Incorrect VAT handling, e-invoicing missteps, or invalid local formats risk legal penalties.

Expert Insight:

“As a GCC SaaS founder, our timeline ballooned because we ignored FATOORA’s specifics and had to re-architect billing from scratch. Local advisors early on make all the difference.”

Real-World Case Study: Inside a GCC SaaS Build (Industry Example)

- Problem:

GCC property firms needed a cloud CRM that supported Arabic, was compliant with KSA’s PDPL, and could integrate with FATOORA. - Approach:

Built separate tenancy for major clients, hosted transactional data in KSA (Azure KSA), and developed fully RTL Arabic UX. Integrated with ZATCA’s e-invoicing APIs. - Obstacles:

Initial translation missed sector-specific Arabic terms; compliance review flagged non-standard invoice fields. Pivoted to include bilingual legal support and process audits. - Results:

Achieved go-live in 5 months, cleared multiple bank/real estate compliance audits, and won tenders requiring KSA data residency. - Lessons:

Early regulatory mapping, in-market QA, and modular architecture were critical for passing audits and scaling cross-GCC.

Frequently Asked Questions (FAQ): SaaS Application Development for GCC

What is SaaS application development for GCC markets?

SaaS application development for gcc involves building cloud based software tailored to Gulf Cooperation Council markets, ensuring localization, regulatory alignment, and sector specific readiness. It includes Arabic language support, regional billing standards, secure cloud hosting, and full gcc saas compliance with national data laws.

What are the GCC SaaS compliance requirements?

Gcc saas compliance requirements include adherence to PDPL data protection laws, VAT compliant invoicing, FATOORA e invoicing integration in Saudi Arabia, data residency mandates, and security certifications such as ISO 27001 or ISO 42001. Meeting gcc saas compliance ensures legal deployment across UAE, KSA, and other Gulf states.

How does PDPL affect SaaS application development for GCC?

PDPL directly impacts saas application development for gcc by regulating how user data is collected, processed, stored, and transferred. Gcc saas compliance requires explicit user consent, secure data hosting within approved jurisdictions, and user rights such as deletion or export functionality.

What are the typical costs for SaaS application development for GCC?

Saas application development for gcc typically costs AED 160,000 to 350,000 for MVPs and can exceed AED 900,000 for enterprise platforms. Costs increase based on gcc saas compliance requirements, Arabic localization, cloud configuration, and third party integrations.

Which cloud providers support GCC SaaS compliance?

For gcc saas compliance, most companies host on AWS UAE, Microsoft Azure UAE or KSA, or approved regional providers such as G42. Cloud selection must align with gcc saas compliance requirements, especially data residency rules for regulated industries.

How do you localize a SaaS platform for GCC users?

Saas application development for gcc requires right to left interface design, professional Arabic translation, dual language workflows, region specific billing formats, and culturally aligned UX. Localization is a core part of gcc saas compliance for market acceptance.

Why is ISO certification important for GCC SaaS compliance?

ISO certifications such as ISO 27001 and ISO 42001 strengthen gcc saas compliance by demonstrating structured security and AI governance frameworks. Many enterprise and government RFPs now require proof of gcc saas compliance requirements through recognized standards.

What mistakes should founders avoid in SaaS application development for GCC?

Common mistakes include ignoring gcc saas compliance requirements early, delaying Arabic UX implementation, choosing non compliant cloud hosting, and failing to integrate VAT or FATOORA systems. Early compliance planning reduces risk and rework costs.

How should multi tenancy be structured for GCC SaaS compliance?

For saas application development for gcc, multi tenancy architecture should align with compliance levels. Shared databases may suit low risk apps, while high compliance sectors such as banking or government often require isolated or single tenant environments to meet gcc saas compliance standards.

How can SaaS platforms stay compliant with evolving GCC regulations?

Future proof saas application development for gcc by adopting modular architecture, tracking regulatory updates, conducting regular audits, and proactively aligning with gcc saas compliance requirements. Early compliance integration minimizes disruption as laws evolve.

Conclusion: Succeeding in GCC SaaS—Your Next Steps

Winning in SaaS application development for GCC markets depends on a region-ready mindset—deep compliance, robust data residency, and seamless Arabic-first experiences.

By following this guide as your execution blueprint, you’ll avoid common pitfalls, confidently unlock new Gulf opportunities, and future-proof your solution for regulatory evolution.

Ready to take action? Consider starting with a compliance audit, request an in-depth GCC SaaS demo, or consult subject-matter experts to tailor your growth journey.

Key Takeaways

- Local-first SaaS design is non-negotiable in GCC: prioritize compliance, data residency, and Arabic UX from day one.

- Regulatory complexity is high—always consult local legal/technical advisors before build.

- Modular, flexible architecture and phased rollout lower risk and timeline surprises.

- Localization is more than translation—includes billing, payment methods, API integrations, and legal formats.

- Early investment in compliance and regional testing pays dividends at scale.

This page was last edited on 17 February 2026, at 10:53 am

Contact Us Now

Contact Us Now

Start a conversation with our team to solve complex challenges and move forward with confidence.