AI agents in finance in UAE are revolutionizing how banks and fintechs approach compliance, operational efficiency, and sustainable growth. As digital transformation accelerates and regulatory demands intensify, traditional automation alone no longer delivers the speed, adaptability, or intelligence required to stay competitive.

UAE financial institutions face mounting challenges: evolving Central Bank guidelines, increasingly complex KYC and AML requirements, and rising customer expectations for seamless, secure digital experiences. Relying solely on rigid automation or manual oversight can result in higher compliance risks, slower processes, and missed growth opportunities.

This guide delivers a practical, region-specific playbook to help UAE finance leaders leverage AI agents—autonomous, decision-capable software systems designed for high-stakes compliance and value generation. You’ll gain a step-by-step strategy, regulatory checkpoints, integration guidance, and visual frameworks aligned with UAE laws and business realities, empowering your organization to act with confidence, precision, and speed.

Key Takeaway Table: AI Agents in UAE Finance at a Glance

| Feature/Area | What to Know |

| Top Benefits | Lower costs, faster onboarding, stronger compliance, innovation edge |

| Key Compliance | CBUAE, DIFC, ADGM guidance; local data residency; explainable AI |

| Top Use Cases | KYC automation, AML/fraud monitoring, customer service, Islamic workflows |

| Implementation Steps | Assess → Select Vendor → Pilot (with UAE compliance checks) → Scale |

| Integration Alerts | Core banking/CRM systems, data security, role-based controls |

What Are AI Agents in UAE Finance?

AI agents in UAE finance are autonomous software systems that operate independently to manage workflows like KYC, AML, and customer onboarding, ensuring compliance with UAE-specific regulations.

Unlike traditional robotic process automation (RPA) or scripted workflows, agentic AI platforms use advanced reasoning, learning, and decision-making to tackle complex, evolving challenges. Where RPA automates routine, rule-bound tasks, AI agents adapt in real time, analyze diverse data streams, and act on their own within pre-set compliance controls.

Key Characteristics of AI Agents in UAE Finance

- Autonomous Operation: Perform tasks and make decisions with minimal human intervention.

- Regulatory Awareness: Map processes to requirements from the UAE Central Bank (CBUAE), DIFC, and ADGM.

- Continuous Learning: Improve accuracy and response over time by learning from outcomes and new data.

- Explainable Outputs: Provide clear reasoning behind decisions—critical for audit and compliance.

Example Workflows

- KYC/eKYC identity verification

- AML and sanctions screening

- Customer onboarding

- Ongoing transaction monitoring

“AI agents in UAE finance are autonomous software entities that streamline compliance, onboarding, and risk management—meeting stringent CBUAE and DIFC standards.”

Ready To Deploy AI Agents In Your Financial Institution?

How Do AI Agents Work in UAE Financial Institutions?

AI agents in UAE banks and fintechs interact with internal systems, external data sources, and compliance protocols to automate end-to-end financial processes with intelligence and transparency.

Process Flow

- Input Capture: AI agents ingest data from onboarding forms, scanned documents, core banking platforms, and external KYC data sources.

- Analysis & Decision Loop: Using agentic process automation, the agent evaluates data against compliance rules (CBUAE, FATF) and risk models.

- Action Execution: Agents validate customer identities, flag unusual activities, or escalate issues to compliance officers as needed.

- Continuous Monitoring: Agents track transactions in real time, learning from flagged and resolved cases to improve detection and workflow logic.

- Audit and Explainability: All actions are logged, with justifications provided for regulatory audits and ongoing oversight.

Typical System Touchpoints

- Core banking systems (e.g., Temenos, Oracle)

- CRM platforms (e.g., Salesforce, Microsoft Dynamics)

- Document intelligence and digital identity providers

Visual Workflow Example:

A new customer submits a digital onboarding application. The AI agent pulls identity documents, cross-references government lists, applies CBUAE compliance rules, and either approves, flags for review, or automatically requests additional documentation—all in minutes.

What Is the Regulatory Environment for AI Agents in UAE Finance? (CBUAE, DIFC & ADGM)

Deploying AI agents in UAE finance requires strict alignment with an evolving regulatory landscape governed by CBUAE, the Dubai International Financial Centre (DIFC), Abu Dhabi Global Market (ADGM), and global standards like FATF.

Key Regulatory Pillars

- CBUAE Guidance: Emphasizes responsible AI, data privacy, and adherence to digital transformation standards.

- DIFC & ADGM: Both free zones require compliance with international KYC/AML frameworks, explicit data residency, and robust technology governance.

- FATF Recommendations: UAE entities must follow Financial Action Task Force guidelines on digital identity, transaction monitoring, and explainable AI use.

- Data Residency: Sensitive financial and identity data must remain within UAE borders, unless a legal exemption applies.

Mapping AI Agent Features to Compliance Duties

| Compliance Area | UAE Regulator | AI Agent Feature |

| KYC/AML | CBUAE, DIFC, ADGM | Real-time identity verification, continuous monitoring |

| Data Privacy | CBUAE, FATF | Local data storage, encrypted transmission |

| Explainability | All | Transparent, auditable decision-logs |

| Human Oversight | All | “Escalate to compliance officer” workflow |

Where Are AI Agents Used in UAE Finance?

AI agents drive the most value in UAE finance by automating high-impact workflows prone to manual inefficiency, error, or regulatory scrutiny.

Top Use Cases

- KYC/eKYC Automation

AI agents extract and validate identity documents, screen against watchlists, and flag anomalies in minutes, reducing onboarding times and risk. - AML & Fraud Monitoring

Agents continuously scan transactions for suspicious patterns, automatically escalate cases for SAR (Suspicious Activity Report) filing, and ensure ongoing compliance. - Customer Service Automation

24/7 multilingual chatbots support customers in Arabic and English, handle account inquiries, and guide users through digital processes. - Risk Management

Proactive detection of regulatory or market risk through cross-platform data aggregation and analytics.

Comparison Table: Agentic AI vs. RPA vs. Legacy

| Capability | Agentic AI | RPA | Legacy Automation |

| Adapts to new rules/data | Yes | Limited | No |

| Real-time compliance | Yes | No | No |

| Continuous learning | Yes | No | No |

| Explainable/auditable | Yes | Limited | Limited |

| Multilingual support | Yes (built-in) | Add-on | No |

| Regulatory mapping (UAE) | Yes | Partial/manual | No |

Workflow Example:

End-to-end KYC agent workflow:

1. Customer submits documents

2. AI agent extracts/validates data

3. Runs AML screening

4. Issues result or flags for manual review

5. Logs actions for audit

What Are the Benefits of Deploying AI Agents in UAE Banks & Fintechs?

Deploying agentic AI in UAE finance delivers significant ROI, competitive advantage, and enhanced compliance—often within months.

Key Benefits

- Efficiency & Cost Savings: Reduce manual processing hours by up to 90% with automated KYC, AML, and customer support.

- Regulatory Accuracy: Fewer compliance breaches through real-time rule mapping and explainability.

- Faster Onboarding & Service: Digital onboarding can drop from days to minutes, improving customer satisfaction and conversion rates.

- Multilingual & Localized Service: Serve both Arabic-speaking and expat customers, supporting Islamic banking workflows.

- Market Innovation & Trust: Early adoption signals technological leadership—important for reputation and attracting tech-forward clients and partners.

Benefits include lower costs, faster onboarding, improved compliance, and a stronger innovation profile for UAE banks and fintechs.

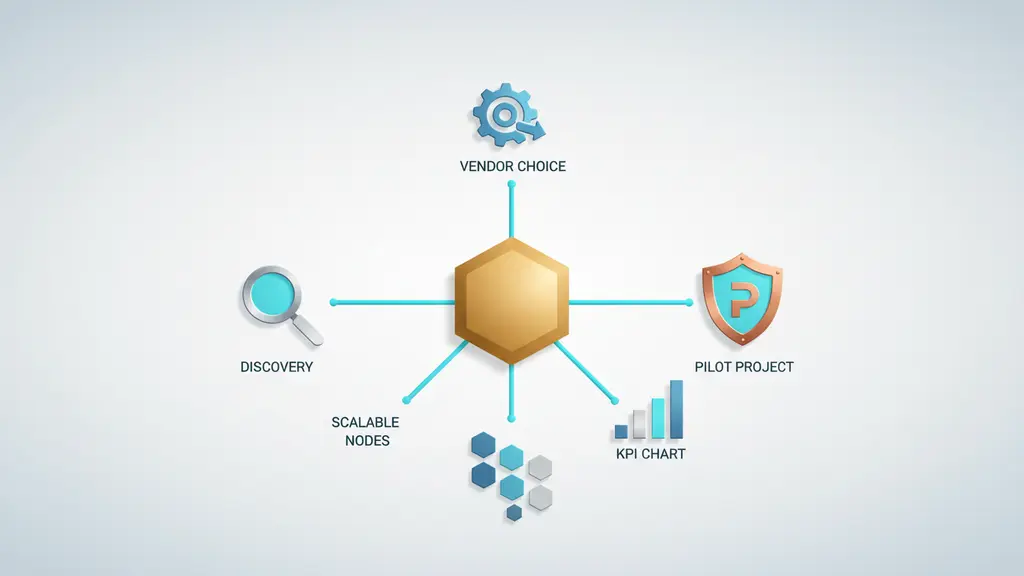

How Can You Implement AI Agents in Finance in UAEzz?

A structured approach ensures successful AI agent adoption without risking compliance or disruption to existing systems.

Step-by-Step Implementation Guide

- Discovery & Needs Assessment

Audit current compliance workflows, IT stack, and regulatory requirements (CBUAE, DIFC, ADGM). - Solution & Vendor Selection

Choose vendors meeting UAE compliance and data residency standards; consult the downloadable compliance checklist. - Pilot Project & Compliance Gates

Deploy AI agents on a contained workflow (e.g., KYC for a new product line). Integrate regulatory sign-offs at each stage. - Scalable Integration

Connect AI agents with core banking, CRM, and document systems; ensure seamless handoff and oversight. - Measurement & Optimization

Track key performance indicators—onboarding time, compliance incidents—and refine workflows.

Implementation Flowchart:

Discovery/Assessment → Vendor Selection → Pilot (with Compliance Checks) → Scaled Integration → KPI Monitoring

What Are Key Integration and Security Considerations?

Successful integration depends on aligning AI agents with existing UAE banking platforms and meeting strict security standards.

- System Compatibility: Ensure agentic AI can connect with your core platforms (e.g., Temenos, Oracle, Salesforce).

- Data Residency & Privacy: All sensitive data should be processed on local/cloud servers compliant with UAE law.

- Role-Based Access: Limit agent actions to defined user groups; ensure explainable AI for audits.

- CISO Checklist:

- Encrypted data storage and transmission

- Continuous security monitoring

- Regular compliance audits

What Challenges and Risks Should UAE Banks Consider With AI Agents?

Deploying AI agents in UAE finance carries unique risks, from regulatory to technical, that leaders must prepare to manage.

Common Challenges and Mitigation Strategies

| Challenge | Risk | Mitigation Strategy |

| AI “Black Box” Decisions | Compliance gaps | Use explainable AI, log all actions |

| Regulatory Changes | Non-compliance | Adopt modular workflows for quick updates |

| Cybersecurity Threats | Data leakage, breaches | Encrypted, UAE-based infrastructure |

| Human Oversight (CBUAE Req.) | Decision errors | Human-in-the-loop review on flagged cases |

| AI Governance | Audit failures | Implement continuous monitoring/auditability |

How Do AI Agents Serve Islamic Banking and Multilingual Workflows in the UAE?

AI agents are particularly valuable for Islamic banks and institutions serving the UAE’s diverse, multilingual population.

Tailored Capabilities for Islamic and Multilingual Banking

- Sharia Compliance: Agentic workflows can be programmed to enforce Sharia banking rules, such as profit-and-loss sharing and exclusion of interest-bearing products.

- Arabic Language Support: AI agents process and interact seamlessly in Arabic, as well as English and other major expat languages commonly used in the UAE.

- Localization: Adapt to local regulations and cultural nuances, ensuring customer satisfaction and legal compliance.

- Example:

A leading UAE Islamic bank deployed agentic AI for Arabic digital onboarding, enabling faster, Sharia-compliant account opening for both citizens and expatriates.

What Is the Future of Agentic AI in UAE Finance? (Trends & Next 3–5 Years)

Over the next few years, agentic AI in UAE finance is expected to move from specialized use cases to enterprise-wide transformation, shaped by regulatory innovation and technological advancements.

Emerging Trends

- Intelligent, Self-Evolving Agents: AI agents will continuously adapt to new regulations and financial products without substantial reprogramming.

- Regulatory Sandboxes: Initiatives like the CBUAE innovation sandbox and Ministry of AI programs are accelerating pilot projects and safe experimentation.

- Accelerated Adoption: UAE financial institutions are rapidly scaling from pilots to institution-wide deployment, as shown in recent industry adoption reports.

- Convergence of Compliance & Technology: Expect greater overlap between compliance frameworks and AI governance standards, driving more consistent implementation.

- Focus on Explainability: With regulatory scrutiny increasing, explainable AI and transparent audit trails will become non-negotiable.

FAQs: AI Agents in UAE Finance

What are AI agents in UAE finance and how do they work?

AI agents are autonomous software systems that automate high-stakes processes such as KYC, AML, and customer onboarding in line with UAE regulatory requirements. They learn and make decisions using advanced analytics, minimizing manual intervention.

How do AI agents automate KYC and compliance for UAE banks?

They extract and validate identity documents, screen customers against local and global watchlists, and flag anomalies for review, ensuring real-time adherence to CBUAE and DIFC guidelines.

What benefits do agentic AI solutions offer for UAE financial institutions?

Benefits include reduced manual workload, improved compliance accuracy, faster onboarding, better customer experiences, and enhanced reputation as a tech leader in the region.

What steps are needed to implement AI agents in the UAE finance sector?

Start with an assessment of regulatory needs and IT stack, select a compliant solution provider, run a pilot with compliance oversight, then scale across more workflows and measure results.

How do AI agents align with UAE Central Bank and DIFC compliance regulations?

By mapping decision-making workflows to CBUAE, DIFC, and ADGM requirements, maintaining data privacy, local data residency, and providing audit-ready explainable actions.

Can AI agents be integrated with existing banking systems in the UAE?

Yes. Leading solutions are designed to plug into core banking, CRM, and document systems commonly used in the UAE, with strict attention to security and data residency.

Are AI agents suitable for Islamic banking or Arabic language support?

Absolutely. Modern agentic AI platforms can be tailored for Sharia-compliant workflows and offer native Arabic (and multilingual) processing and support.

What are the potential risks and governance considerations for AI in UAE finance?

Risks include lack of explainability, regulatory gaps, cybersecurity threats, and insufficient oversight. Mitigation involves explainable AI, compliance gates, and continuous monitoring.

How quickly can UAE banks and fintechs realize ROI from AI agent investment?

ROI is often realized within 6–12 months, with immediate wins in manpower reduction, faster compliance, and improved customer satisfaction.

What is the future outlook for agentic AI in UAE financial services?

Expect rapid adoption, increased regulatory support, and more intelligent, adaptive AI agents driving compliance and customer experience at scale.

Conclusion: Why UAE Finance Leaders Should Act Now

The transformation brought by AI agents in UAE finance is no longer a distant prospect—it is an urgent, strategic imperative. As regulations tighten and customer expectations rise, waiting means higher costs, bottlenecks, and lost market share.

Executive leaders who act now stand to benefit from faster compliance, lower operational costs, and a more attractive market position. By following a proven, UAE-specific roadmap—and prioritizing security, regulatory alignment, and customer needs—your organization can move confidently into the next era of banking innovation.

Ready to make the shift?

Download the UAE AI Agent Compliance Checklist or consult with a certified UAE fintech AI specialist today to begin your transformation journey.

Key Takeaways

- AI agents in UAE finance are essential for compliance, efficiency, and innovation.

- Success depends on regulatory alignment, secure integration, and explainable AI.

- Key use cases: KYC automation, AML, customer service, and Islamic workflows.

- Following a step-by-step roadmap ensures safe, scalable deployment.

- Early adoption secures ROI and competitive advantage for UAE financial institutions.

This page was last edited on 16 February 2026, at 12:27 pm

Contact Us Now

Contact Us Now

Start a conversation with our team to solve complex challenges and move forward with confidence.