Cryptocurrency exchange software lies at the heart of the digital asset boom, powering everything from market giants to niche trading platforms. But building a crypto exchange is both an enormous opportunity and a complex challenge.

Navigating the fast-growing market—now seeing billions in daily volume—means grappling with fierce competition, evolving regulations, and persistent security threats. User trust, scalable technology, and iron-clad compliance are non-negotiable.

This guide offers founders, CTOs, product leads, and investors a clear, end-to-end roadmap for how to build cryptocurrency exchange software in 2026. It covers every critical phase—market research, legal requirements, technical decisions, security, costs, launch, and long-term operations—with actionable steps and insights.

What you’ll learn:

- Types of exchanges (CEX, DEX, Hybrid) and business models

- Market planning and KYC/AML compliance requirements

- Essential crypto exchange software features

- How to select the right technology stack

- Step-by-step build process from idea to deployment

- Cost analysis and budget planning

- Security and operational best practices

- White-label vs. custom exchange decision framework

- Scalability and advanced features for future growth

What Is a Cryptocurrency Exchange? Types, Models & Key Concepts

A cryptocurrency exchange is an online platform for buying, selling, or trading digital assets. Exchanges come in several models, each with unique features and compliance implications.

Types of Exchanges—Quick Definitions:

- Centralized Exchange (CEX): Operated by a company; manages user funds and order books (e.g., Coinbase, Binance).

- Decentralized Exchange (DEX): Peer-to-peer, non-custodial trades occur via smart contracts (e.g., Uniswap).

- Hybrid Exchange: Combines CEX user experience with DEX privacy or security features.

All models facilitate trading but differ in control, security, and compliance. Typically, users interact by signing up, depositing funds, placing orders, and withdrawing assets. Core modules include a trading engine, wallet integration, user verification (KYC), and liquidity management.

CEX vs. DEX vs. Hybrid: Feature Comparison

| Feature | Centralized (CEX) | Decentralized (DEX) | Hybrid |

| Custody of Funds | Platform holds | Users self-custody | Both, by config |

| KYC/AML Compliance | Mandatory | Often optional | Flexible |

| Performance | High throughput | Blockchain-limited | Adaptive |

| User Experience | Streamlined | Varies | Customizable |

| Security Risk | Target for hacks | Smart contract bugs | Mixed |

| Liquidity Management | Via providers | AMM/pools | Combination |

| Jurisdictional Issues | Yes | Fewer (so far) | Depends |

Key takeaway:

Your choice of exchange type directly affects technical, business, and legal requirements.

How to Plan Your Crypto Exchange: Market, Business Model, and Compliance Foundations

Before writing code, successful crypto exchanges begin with robust planning—covering research, business modeling, and compliance.

Planning Steps for Crypto Exchange Development:

- Market and Competitive Research: Analyze existing platforms, target regions, user segments, trading volumes, and unmet needs. Evaluate direct competitors’ features, pricing, and compliance stance.

- Choose Your Business Model: Decide if you will be a traditional exchange, broker, hybrid, or add social features like copy trading. The model impacts technology, partnership, and regulatory obligations.

- Understand Regulatory Requirements: Map out KYC (Know Your Customer) and AML (Anti-Money Laundering) rules in your target jurisdictions. Crypto exchange licensing varies substantially by country.

- Select Jurisdiction and Entity Structure: Determine where to incorporate—local or offshore. This impacts your compliance workload, banking, and user trust. Consult with legal or compliance experts before proceeding.

- Align with Compliance Specialists: Engage legal professionals specializing in cryptocurrency regulation early to avoid costly missteps.

Crypto Exchange Planning Checklist:

- Conduct market/competitor analysis

- Define the business model and the target customer

- Identify regulatory/licensing requirements

- Choose jurisdiction, set up legal entity

- Establish a compliance partnership

Bottom line:

Inadequate planning is a leading cause of failed exchanges—tackle business, legal, and compliance foundations first.

What Are the Core Features Required in Cryptocurrency Exchange Software?

Every successful crypto exchange platform relies on a robust suite of integrated features. These address trading, security, compliance, and user experience.

Core Crypto Exchange Software Features:

- Trading Engine: Processes buy/sell orders, matches trades, handles price discovery, and maintains order book integrity.

- Wallet Integration: Supports deposit, withdrawal, and internal transfer of both cryptocurrencies and (where applicable) fiat via hot (online) and cold (offline) wallets.

- Admin Panel: Enables operator oversight, real-time monitoring, compliance tracking, user management, and analytics dashboards.

- KYC/AML Module: Onboards and verifies users, manages compliance data, and triggers regulatory alerts/reporting.

- Liquidity Provider Integration: Connects to external exchanges or market makers to ensure order fulfillment and price depth.

- Payment Gateways: Offers support for fiat conversions—bank transfers, credit cards, and stablecoins.

- Mobile Trading App: Extends exchange features to mobile devices with responsive, secure UX.

- Security Modules: Includes two-factor authentication (2FA), encryption, DDoS protection, withdrawal whitelists, and transaction monitoring.

Feature Checklist & Complexity Table

| Feature | Essential? | Complexity (Low/High) | Note / Cost Driver |

| Trading engine | Yes | High | Core of exchange, development-intensive |

| Wallet integration | Yes | High | Requires secure crypto custody |

| Admin/analytics panels | Yes | Medium | Important for compliance |

| KYC/AML onboarding | Yes | Medium | 3rd-party integration possible |

| Liquidity connectivity | Yes | Medium | Cost depends on providers |

| Payment gateways | Optional | Medium | Adds fiat, licenses needed |

| Mobile trading app | Optional | Medium | Growing user expectation |

| Security modules (2FA, etc.) | Yes | High | Critical for user trust |

Takeaway:

Invest squarely in trading, wallet, and security modules—these distinguish scalable, trustworthy crypto exchanges.

How to Choose the Right Technology Stack for Crypto Exchange Development

Selecting the best technology stack strongly influences scalability, security, and speed to market for your crypto exchange software.

Key Stack Selection Criteria:

- Scalability: Can the stack handle trading volume spikes?

- Security: Does it support modern encryption and audits?

- Developer Pool: Are skills readily available for rapid iteration?

Common Tech Stack Components

Backend:

- Node.js: Popular for real-time trading engines, APIs, and high-concurrency architectures.

- Python: Favored for analytics-heavy modules, compliance automation, and custom logic.

Frontend:

- React: Delivers responsive, dynamic UIs; widely adopted.

- Angular/Vue: Both are strong alternatives for scalable, maintainable frontends.

Blockchain Integration:

Use established libraries for wallet management and asset integration (e.g., Web3.js, ethereum libraries). Ensure robust handling of private keys and transaction signing.

APIs:

REST and WebSocket APIs: For trading, market data, and wallet functions.

Database:

PostgreSQL: Reliable for order book storage, transaction history.

MongoDB: Used for flexible document-based modules.

Open-Source Frameworks: Consider platforms like Openware/OpenDAX for modular, pre-built crypto exchange architecture.

Deployment:

Cloud (AWS, GCP, Azure): Scalable and flexible, often preferable for most startups.

On-Premises: Sometimes required for strict jurisdictions or custom control.

Example Crypto Exchange Tech Stack Table:

| Layer | Tech Option 1 | Tech Option 2 | Use Case |

| Backend | Node.js | Python | Trading logic, APIs |

| Frontend | React | Angular/Vue | Dashboard, web/mobile UI |

| Database | PostgreSQL | MongoDB | Transaction/order data |

| Blockchain | Web3.js | Custom libs | Asset integration |

| API | REST, WebSocket | gRPC | Data & trading endpoints |

| Deployment | AWS/Azure/GCP | On-premises | Hosting/scaling options |

Tip:

Choosing proven stacks and frameworks accelerates build time and reduces technical risk.

Step-by-Step Process: How to Build a Cryptocurrency Exchange Platform

Developing a cryptocurrency exchange software requires a structured step-by-step approach, involving business, legal, and technical workflows.

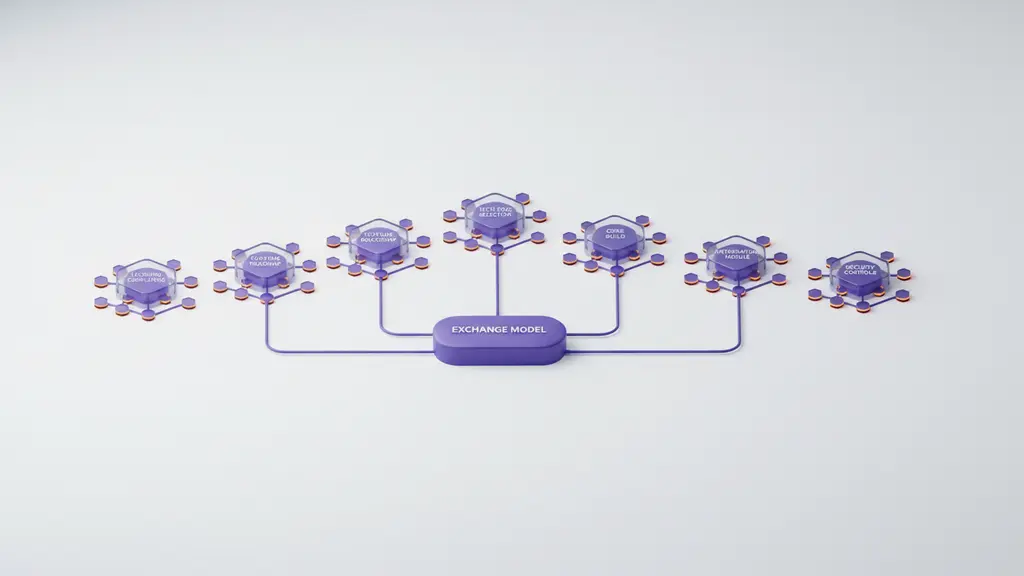

Crypto Exchange Platform Development Roadmap

- Define Your Exchange Model

Assess user, business, and regulatory needs; select CEX, DEX, or hybrid. - Comply with Regulations and Acquire Licenses

Secure KYC/AML systems, apply for necessary licenses based on chosen jurisdiction. - Gather Requirements and Map Out Product Features

List mission-critical features, set timelines, and create a feature roadmap aligned to market data. - Select or Build Your Technology Stack & System Architecture

Choose backend/frontend languages, database systems, and blockchain protocols. - Design User Flows and UX/UI for Web and Mobile

Develop wireframes and user journeys for both trading and onboarding. - Develop Core Exchange Modules

Build the trading engine, wallet integration, admin controls, and compliance modules. - Integrate Liquidity Providers and Payment Gateways

Connect with external liquidity pools or exchanges and add fiat onramps as needed. - Implement Security and Compliance Controls

Set up technical security (encryption, 2FA, DDoS) and compliance (KYC/AML screening, audit logs). - Comprehensive Testing

Run unit tests, integration/load tests, penetration testing, and bug bounty programs. - Plan and Execute Go-Live Launch

Prepare marketing, user onboarding, and real-time monitoring. - Set Up Ongoing Maintenance and Upgrade Cycles

Schedule regular updates, compliance audits, and performance reviews.

Visual Reference: Crypto Exchange Build Steps

1. Define Model → 2. License/Compliance → 3. Feature Roadmap → 4. Tech Stack/Architecture → 5. UX/UI → 6. Build Core → 7. Integrations → 8. Security/Compliance → 9. Test → 10. Launch → 11. Maintain/Upgrade

Pro tip:

Strict sequencing improves outcomes—skipping compliance or security early can be devastating later.

How Much Does It Cost to Build Cryptocurrency Exchange Software?

Understanding the cost to build crypto exchange software is essential for planning and ROI assessment. Costs vary widely based on scope, region, model (CEX/DEX), and technology decisions.

Key Crypto Exchange Cost Drivers:

- Feature set: Complex trading engines, fiat support, and compliance modules add cost.

- Tech stack: Custom backend/frontend and blockchain integrations are more expensive.

- Development team: Rates vary by region; US/EU highest, Asia/Eastern Europe lower.

- Compliance: Licensing and legal fees are significant in regulated markets.

- Ongoing costs: Cloud hosting, security audits, tech support, compliance updates.

Sample Crypto Exchange Cost Breakdown

| Scenario (MVP) | CEX Barebones | CEX Full Suite | DEX Basic | DEX Advanced |

| Core Dev (USD) | $120,000 | $400,000+ | $80,000 | $250,000 |

| Compliance/Legal | $20,000+ | $100,000+ | $10,000 | $50,000 |

| Security & Audits | $15,000 | $50,000 | $10,000 | $40,000 |

| Hosting/Ops (annual) | $12,000 | $30,000 | $8,000 | $24,000 |

| Total (Est.) | $167,000+ | $580,000+ | $108,000 | $364,000 |

Estimates may vary significantly based on region, complexity, and business model.

Ongoing Costs:

Updates, security/testing, compliance reviews: $3,000–$10,000+/month for most platforms.

Build vs. Buy (White-Label) Overview:

Turnkey solutions start around $50,000–$250,000 but bring monthly/exchange fees.

Funding and Revenue Basics:

Many exchanges seek investment to cover initial costs, offset with transaction, listing, and withdrawal fees.

Summary:

Budget for both build and run phases—underestimating compliance/security inflates true total cost of ownership.

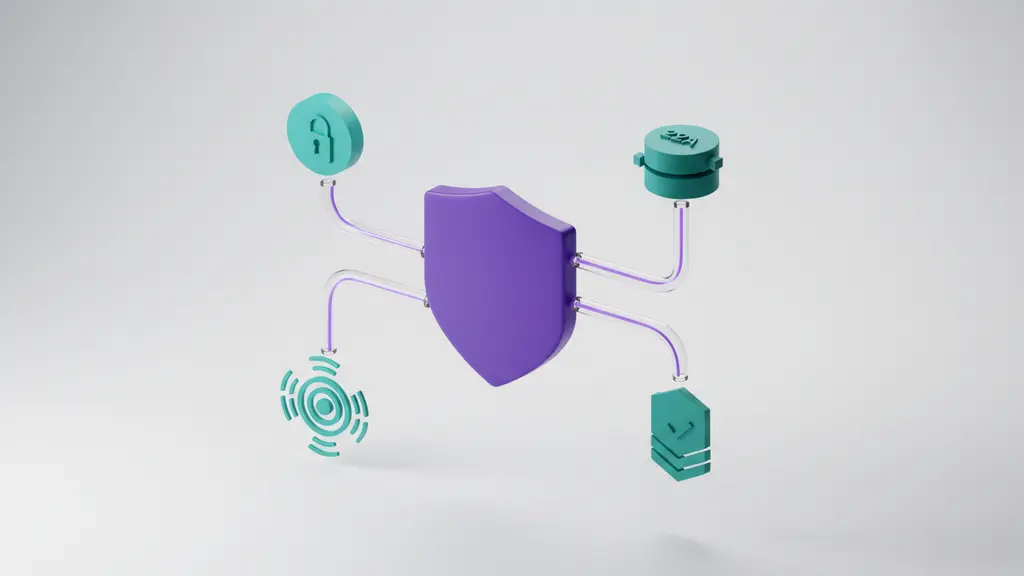

What Security and Compliance Measures Are Essential for Crypto Exchanges?

Security and regulatory compliance are the foundation of long-term crypto exchange survival. Breaches and non-compliance have repeatedly led to high-profile exchange failures and legal actions.

Crypto Exchange Security & Compliance Essentials:

- KYC/AML: Mandatory onboarding and continuous monitoring; verify user identity and transaction legitimacy.

- Security Threats: Address risks like hacking, DDoS, phishing, and wallet compromise.

- Best Practices:

- Data encryption at rest and in transit

- Two-factor authentication (2FA) for users and admins

- Regular code audits, third-party penetration testing

- DDoS protection services and traffic monitoring

- Withdrawal whitelists and transaction alerts

- Cold/hot wallet separation with secure key management

- Regulatory Compliance: Integrate robust reporting, transaction monitoring, and work with compliance partners for jurisdictional requirements.

Security & Compliance Checklist

- KYC/AML onboarding and monitoring in place

- User and admin 2FA enabled

- End-to-end data encryption

- Periodic penetration testing performed

- External bug bounty program or code audit

- DDoS mitigation tools active

- Wallet key storage secured (preferably hardware/air-gapped)

- Compliance team or partner onboarded

Takeaway:

Embedding security and compliance from day one protects your users, reputation, and business.

Should You Use White-Label or Build a Custom Crypto Exchange? [Decision Framework]

Founders must decide between white-label solutions and building custom crypto exchange software. Each approach has trade-offs in speed, cost, flexibility, and control.

What is a White-Label Crypto Exchange?

- Pre-built, customizable platforms licensed from vendors.

- Pros: Faster launch (weeks), lower up-front cost, vendor support.

- Cons: Less technical flexibility, feature constraints, vendor lock-in risks.

Custom Exchange Development:

- Bespoke platform built from scratch or frameworks.

- Pros: Total control, unlimited customization, advanced features possible.

- Cons: Higher cost, longer time-to-market, complex project management.

| Factor | White-Label | Custom Build |

| Time to Launch | Weeks–2 months | 6–12+ months |

| Upfront Cost | $50,000–$250,000 | $120,000–$500,000+ |

| Customization | Limited | Unlimited |

| Compliance Control | Partial (shared) | Full |

| Support/Upgrades | Vendor | In-house/partners |

| Security Control | Vendor-dependent | Full/own responsibility |

When to Use Each:

- White-label: Fast MVP, regulatory testing, budget constraints, new startups.

- Custom: Advanced features, full compliance control, unique UX, scaling plans.

Hidden Considerations:

Vendor track record, security practices, and ongoing fees are critical for white-label. For custom builds, internal tech resources and a maintenance plan are mandatory.

Decision tip:

Align your approach to business goals, growth plan, and regulatory environment.

How to Integrate Social/Community Features and Ensure Long-Term Scalability

Building community-driven and scalable crypto exchange software addresses both current trends and future-proofing.

Advanced Features and Scale Best Practices:

- Social/Community Trading: Integrate leaderboards, community chat, copy trading, and social signals to boost engagement and retention.

- Modular/Microservices Architecture: Use loosely coupled modules for trading, wallet, analytics, and compliance to enable rapid scaling and feature updates.

- Localization and Internationalization: Support multiple languages and currencies to reach global audiences.

- Performance Optimization: Optimize for real-time data feeds, API throughput, and low-latency order matching.

Mini-Case Study: Social Exchange Launch

A newly launched hybrid exchange in APAC grew user signups 30% faster after implementing copy-trading and community chat features—demonstrating social modules can directly influence adoption and retention when launched with robust moderation and privacy controls.

Pro tips:

- Plan modularity for easier scaling and feature integration.

- Community features can be rolled out as optional modules post-launch.

Launching, Maintaining, and Scaling Your Crypto Exchange

Launching a crypto exchange is only the beginning; robust maintenance and scalability measures are vital for long-term success.

Operational and Growth Checklist:

- Pre-Launch (“Soft Launch”): Conduct beta testing, onboard initial users, run stress/load tests, and finalize support channels.

- Post-Launch Support: Deliver 24/7 user support, real-time issue monitoring, and instant incident response workflows.

- Continuous Upgrades: Regularly patch software, update compliance modules, and add features based on user demand and regulatory shifts.

- Regulatory Adaptation: Monitor and respond to new laws affecting trading pairs, KYC, or cross-border operations.

- Expand Features/Liquidity: List new tokens and assets, grow liquidity sources, and consider partnership or integration opportunities.

- Scaling Teams: Grow technical teams and support infrastructure to match rising volumes and geographic expansion.

Takeaway:

Ongoing investment in operations, compliance, and user experience is critical for scaling a trustworthy crypto exchange.

Example Case Studies and Lessons Learned

Examining real-world cases reveals practical lessons for crypto exchange builders.

Case 1: Successful CEX Launch

A European exchange launched with phased regulatory approval, an MVP trading engine, and limited fiat support. Early focus on compliance and robust wallet security resulted in investor confidence and steady user growth.

Lesson:

Staged rollouts and early compliance partnerships can accelerate time-to-market while reducing operational risk.

Case 2: DEX Security Shortfall

A decentralized exchange with custom smart contracts suffered an exploit due to untested code, resulting in significant fund losses and trust erosion.

Lesson:

No matter how decentralized, rigorous code audits and bug bounties are imperative. Never skip third-party security checks before going live.

Expert Opinion:

“Treating compliance and security as afterthoughts is the fastest route to disaster in crypto exchange development.”

— Senior Compliance Officer, CryptoFin Solutions

FAQ: Cryptocurrency Exchange Software Development

1. What are the key steps to building a cryptocurrency exchange platform?

The main steps are: conduct market/business research, meet regulatory requirements, choose exchange type, define technology stack, develop core modules (trading engine, wallets, admin tools), integrate liquidity and payment solutions, implement security/compliance, test thoroughly, launch, and maintain/upgrade continuously.

2. How much does it cost to develop cryptocurrency exchange software?

Costs range from roughly $120,000 for a basic centralized exchange MVP to $500,000+ for a full-featured platform with advanced compliance and security. Decentralized exchanges can cost less for basic versions but rise quickly with customization. Ongoing costs for maintenance and compliance should also be budgeted.

3. What is the difference between a CEX and a DEX?

A CEX (centralized exchange) is operated by a company, manages user funds and order books, and requires regulatory compliance (KYC/AML). A DEX (decentralized exchange) enables peer-to-peer trading using smart contracts, with users maintaining custody of their funds and often less regulatory oversight.

4. What regulatory requirements must be met for a crypto exchange?

Most jurisdictions require Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance, licensing, and reporting of suspicious activities. Requirements vary by country; always consult with legal or compliance experts before launching.

5. Should I use a white-label solution or build from scratch?

If rapid launch and lower upfront costs are priorities, white-label may be ideal. For complete control over features, branding, compliance, and scalability, a custom-built exchange is better. Consider your business model, regulatory needs, and growth plans when deciding.

6. What are the most important security measures for crypto exchanges?

Essential measures include 2FA, strong user authentication, data encryption, DDoS mitigation, regular code audits, wallet segregation (hot/cold storage), and continuous monitoring for suspicious activities.

7. What features are essential for a successful crypto trading platform?

A robust trading engine, wallet integration, compliance (KYC/AML), liquidity provider connections, user-friendly UI/UX, security modules, admin/analytics dashboards, and mobile app support are critical.

8. How do I integrate liquidity providers into my crypto exchange?

Liquidity integration involves connecting your trading engine to external exchanges or market makers via APIs. This can be achieved through direct partnerships, using aggregator services, or connecting to larger CEXs for order book depth.

9. Which technology stack is best for crypto exchange development?

A typical stack includes Node.js or Python for backend, React (or Angular/Vue) for frontend, PostgreSQL or MongoDB for databases, Web3.js for blockchain, and AWS/Azure for deployment. Adapt selections to match your features, scalability, and developer resources.

10. How do I maintain and update a cryptocurrency exchange after launch?

Establish 24/7 support, schedule regular software and security updates, monitor regulatory developments, expand features and trading pairs, and address incidents promptly. Ongoing compliance and performance audits are essential.

Conclusion

Building cryptocurrency exchange software is equal parts opportunity and challenge. The most successful platforms integrate solid business modelling, technical scalability, and best-in-class security and compliance from day one.

This guide has armed you with the full roadmap: from defining your exchange model to handling operational scaling post-launch. Whether you choose a white-label or custom solution, remember that continual investment in security and compliance is non-negotiable.

Key Takeaways

- Crypto exchange development demands detailed planning, legal readiness, and technical rigor.

- Choice of exchange type (CEX/DEX/hybrid) determines features, compliance, and user experience.

- Technology stack selection affects scalability, performance, and security.

- Core features—trading engine, wallet integration, and compliance—are mission-critical.

- Long-term success relies on robust security, continuous maintenance, and regulatory adaptation.

This page was last edited on 29 January 2026, at 12:25 pm

How can we help you?